Gelastogel

Gelastogel: Link Alternatif Login & Daftar Situs Gelas Togel Terpercaya

Gelastogel: Link Alternatif Login & Daftar Situs Gelas Togel Terpercaya

Couldn't load pickup availability

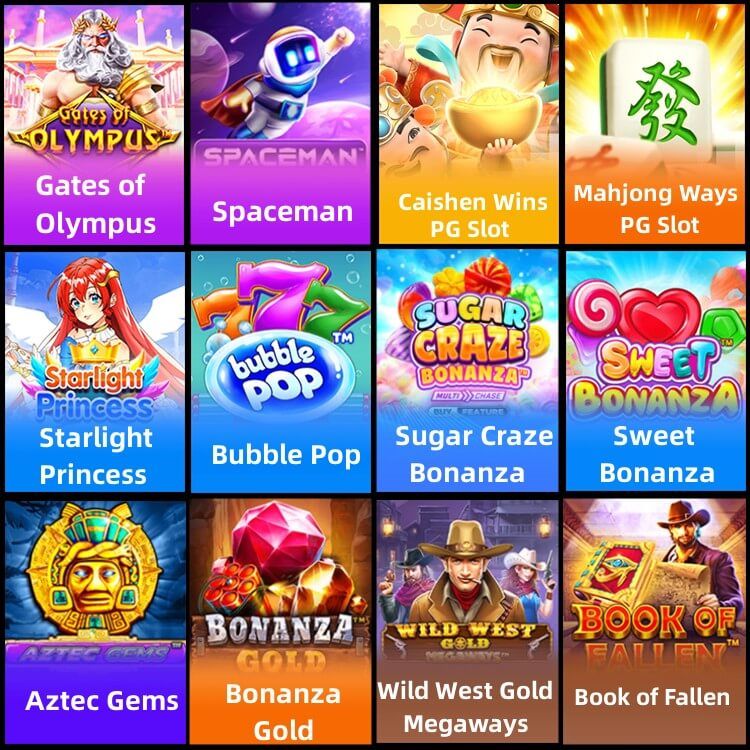

Permainan judi slot online ada istilah yang sering di dengar yaitu slot gacor, Gelastogel merupakan harapan semua pemain slot untuk mendapatkan game slot gacor dimana jika menemukan game slot tersebut maka akan menjadi kunci kemenangan untuk mendapatkan kemenangan besar lewat pembayaran perkalian besar, mendapatkan free game atau mendapatkan babak jackpot.

Game slot online yang gacor biasanya memiliki beberapa karakteristik yang khas atau khusus. Selain winrate yang tinggi, game tersebut seringkali juga dilengkapi dengan fitur bonus yang menarik seperti free spins atau multiplier. Fitur-fitur ini dapat meningkatkan peluang pemain untuk mendapatkan kemenangan lebih besar termaksud fitur babak bonus jackpot.Segera daftar situs Gelastogel pada link alternatif Gelastogel.

Share